The PaymentsJournal Podcast

The PaymentsJournal Podcast

Down the Path to Full Payments Orchestration

Down the Path to Full Payments Orchestration

Description

Many businesses are familiar with payments optimization, which focuses on enhancing the outcome of individual transactions. However, the growing field of payments orchestration takes a broader approach. It addresses larger issues, such as deploying the latest payment methods and technologies faster than competitors and improving payment performance at scale. The goal is to deliver the most secure, frictionless customer experiences while also driving profitability.

Orchestration, at its core, provides the foundation for payments optimization to thrive. In a PaymentsJournal podcast, Brady Harris, CEO of IXOPAY, and Don Apgar, Director of the Merchant Payments Practice at Javelin Strategy & Research, spoke about the benefits of payments orchestration, from dynamic routing to enhanced data and analytics.

Like Conducting an Orchestra

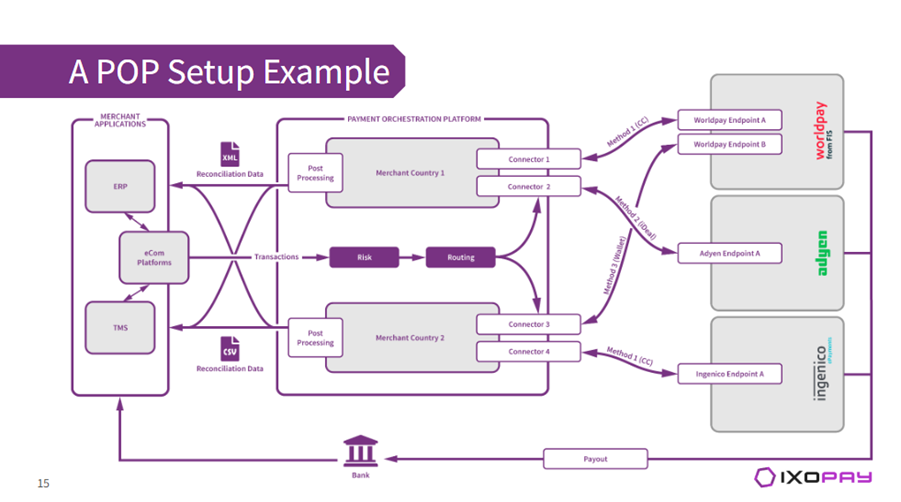

Simply put, payments orchestration unifies a merchant’s payment operations, providing a comprehensive view of what’s happening across the entire ecosystem. It allows them to identify where breakdowns are occurring, resolve inefficiencies, and enhance security by leveraging multiple fraud prevention tools, optimizing authentication processes, and ensuring compliance with global security standards.

Large enterprise merchants typically have as many as 20 or more integrations with various payment service providers (PSPs) and acquirers around the world. IXOPAY has had customers with more than 150 to 200 different processors they’re managing behind the scenes, requiring upwards of 150 to 200 full-time employees. Businesses are starting to move away from off-the-shelf orchestration solutions in favor of a global network of payment providers, typically through a third-party orchestration layer.

“Companies in different industries and sizes start to play this game of payments whack-a-mole,” said Apgar. “They start out with a PSP and find there’s something missing—a new payment type or fraud solution. So another integration layer comes into play and eventually you wind up with this massively complex web of integrations.”

The orchestration mindset drives efficiency into this web of integrations, which were originally built to fill gaps in what was once a simple payment process.

“Before I fill another gap, why don’t I take a step back and see what are the universe of payment solutions that I would like to have?” Apgar asked. “How can I put them all together in one basket, even if I need to use multiple providers and do it in an efficient fashion? It’s like conducting an orchestra where all the all the instruments are playing their individual sounds, but come together to form the music.”

The Promise of Tokenization

IXOPAY started hearing from large global merchants with substantial payment volumes who realized they wanted to own their own data through vaulting solutions. That’s where tokenization comes in. With tokenization, businesses can not only own their data but also leverage it to improve authorization rates and reduce fraud and risk.

“Think about millions of transactions and all of the intelligence that sits at that transactional level—how can you create actionable insights that the business can then synthesize and operationalize back into the business,” said Harris. “When you combine them together in highly configurable, very customizable ways, you are now effectively offering these very large merchants a way to customize and build their own payments infrastructure with out-of-the-box solutions. To me that is next-gen orchestration.”

While tokenization has significantly enhanced data security, it has also reduced visibility into customer data. Tokenization makes it challenging to track customers across different channels and geographies. However, this challenge highlights the importance of orchestration, especially as more enterprise-level merchants explore tokenization strategies that can help unify customer interactions across multiple sales channels.

Another major advantage of payments orchestration is its ability to optimize soft declines, through card lifecycle management tools. In a recurring billing environment, where payments are repeated, cards can expire, or customers may need to replace lost or stolen cards. Even so, the card is still linked to the same name and associated data. Payments orchestration allows entities to refresh this sensitive but important card-level data, resulting in higher authorization rates.

Making Use of the Data

Data and analytics continue to be a major challenge for many merchants.

“We (work with) a large fashion retailer who said they didn’t have a good data strategy on how their different payment methods are being used,” said Harris. “But payment analysis for that merchant is manual. This leads to all kinds of challenges as to where to grow the business, where to expand geographically, what payment acceptance types they should invest in. It’s hard for them to even build out basic roadmap priorities in a way that helps optimize sales and drive revenue.”

Financial reconciliation of this data presents another hurdle. Merchants managing multiple acquirers in an orchestrated environment must reconcile and understand the fees. Additionally, when it comes to chargebacks, merchants need to determine where a transaction was authorized and ensure it’s properly routed back to the right acquirer.

“There’s a lot of day-to-day blocking and tackling of data before you even get into analytics,” said Apgar.

Promise for the Future

Next-gen payment orchestration involves a simplified operations layer designed to handle millions of transactions at scale across multiple providers. It also includes a central access point with dynamic routing that can switch in real time between different processors based on sophisticated rules or requirements. Merchants can customize these rule engines to establish how payment transactions are cascaded.

This is also where artificial intelligence comes into play. As merchants add new geographic locations, and layer in different interchange card types and issuer transactions, rules-based routing becomes increasingly complex. An AI agent, however, can account for all the variables that influence routing decisions, moving beyond a static set of hard-coded rules.

“It’s mind-blowing what that’s going to do as we continue to iterate on this idea of dynamic routing,” said Harris. “I don’t know where it’s headed, but holy cow, the future is bright.

“If you’re a mid-market retailer, look at orchestration as a solution,” he said. “There’s a lot of optimization and a lot of business benefits, typically at a much lower cost. That really frees up businesses to focus on what they do well, which is growing revenue and expanding their business.”

[contact-form-7]

The post Down the Path to Full Payments Orchestration appeared first on PaymentsJournal.